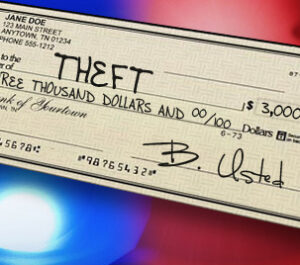

You’ve seen the devastation of Hurricane Helene in the news and online and you want to help the victims. Unfortunately, fraudsters are at work trying to prey on your good nature. Because of this, the U.S. Attorney General is warning the public . Learn More