As we welcome 2025, big changes to Social Security will impact retirees and those nearing retirement. Staying informed is key to maximizing your benefits and planning for financial stability in your golden years. Read More

As we welcome 2025, big changes to Social Security will impact retirees and those nearing retirement. Staying informed is key to maximizing your benefits and planning for financial stability in your golden years. Read More

“Buy Now, Pay Later” (BNPL) services have become increasingly popular, offering a tempting alternative to credit cards. Services like Affirm, Afterpay, and Klarna allow you to buy what you want now and pay for it over time. Add to that an interest-free option and this feels like a no-brainer. It’s convenient, quick, and feels like a smart financial move, but it’s important to understand the fine print. Learn More

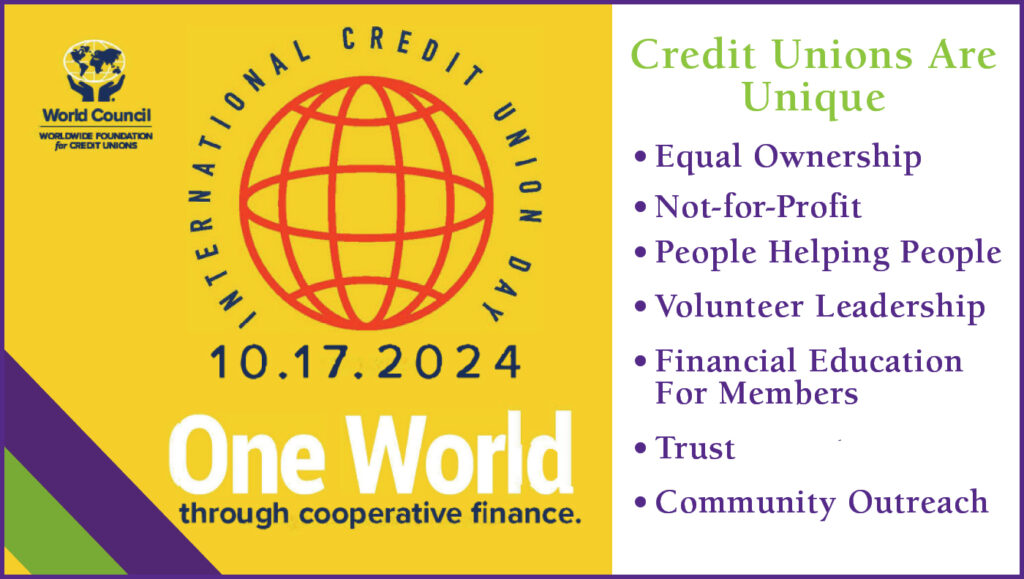

Today, Oct. 17, 2024, is International Credit Union (ICU) Day, a day to celebrate the ways credit unions improve the lives of their members. Learn More

You’ve seen the devastation of Hurricane Helene in the news and online and you want to help the victims. Unfortunately, fraudsters are at work trying to prey on your good nature. Because of this, the U.S. Attorney General is warning the public . Learn More

August 14th is National Financial Awareness Day and it’s a good opportunity to remember that the way we handle our money is a key part of financial wellness.

With COVID-related mortgage, rent, student loan and other relief programs ending, being financially aware is more important now than ever. Yet being financially aware goes well beyond managing everyday bills and expenses. To recognize National Financial Awareness Day, here are five signs that indicate you’re on the path to becoming financially aware. Learn More

24/7 Telephone Teller: 833.MYPFCU1 / 833.697.3281

Recent news headlines have been full of warnings about gift card scams. These reports can make any of us hesitant about purchasing gift cards for a holiday or special occasion. However, there are precautions you can take when shopping for gift cards. Learn More.

Elder financial abuse is when someone illegally or improperly uses an elder’s money or belongings for their own use. The elderly are easy victims for financial abuse for several reasons, including mental impairments. Learn More.

We would like to remind you to always be cautious as the world is experiencing a rise in phishing scams. If you receive an email from a PFCU employee that you were not expecting, please do not click on a link embedded in the email or input user name and password. Contact PFCU at 847.697.3281 to verify the legitimacy of the email. Learn More.

March 8, 2023 is Internation Women’s Day. Today, we’re honoring Dora Maxwell, an early pioneer in the credit union movement. She secured charters for hundreds of credit unions throughout the United States, including, Standard Oil Company of NJ, People’s Natural Gas Company, The Hope Natural Gas Co., and the Sanders Markets. Learn More.

CHAT

PFCU Will Be Closed on Friday, April 18th and Saturday, April 19th

Starting April 22, Members Will Need to Re-Accept the online banking End-User License Agreement. Click HERE for details.